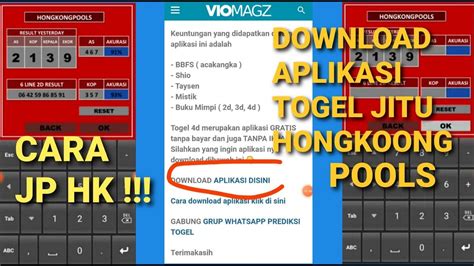

Aplikasi Penghitung Togel Akurat – Permainan Togel telah menjadi fenomena yang populer di kalangan pecinta judi dan penggemar permainan angka. Bagi mereka yang berpartisipasi dalam Togel, mencari cara untuk meningkatkan peluang kemenangan menjadi tujuan utama. Salah satu cara untuk melakukannya adalah dengan menggunakan aplikasi penghitung togel akurat. Di era teknologi yang semakin maju, aplikasi semacam …